The company sees second-half revenue 5%-10% lower than the first at constant currencies

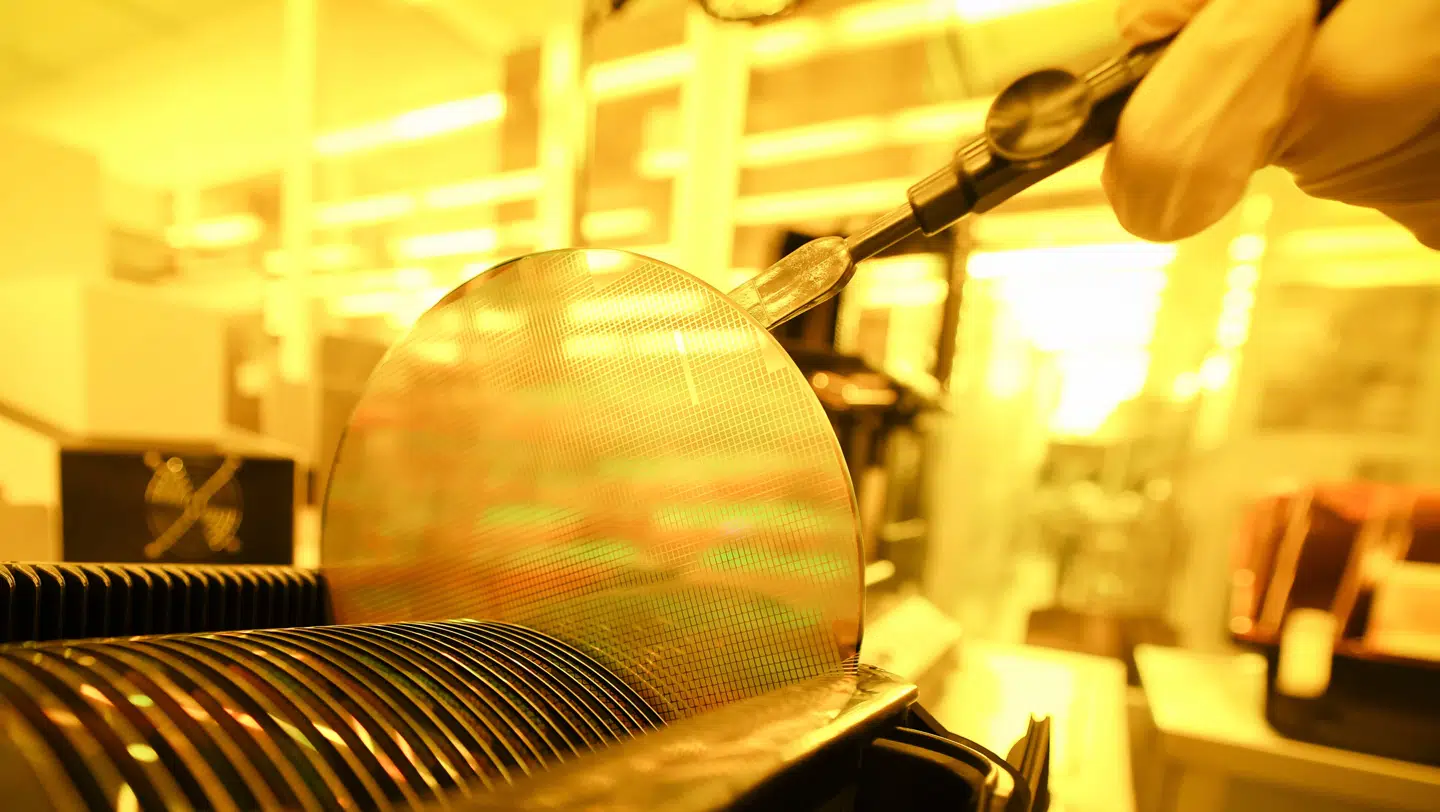

ASM International cut its earnings view for the full year as it anticipates its second-half performance to be hit by lower-than-expected demand in key segments.

Fortsæt uden at betale en krone

Få adgang til artiklen, vores nyhedsbreve og mange flere login-fordele.

Se mereDel: